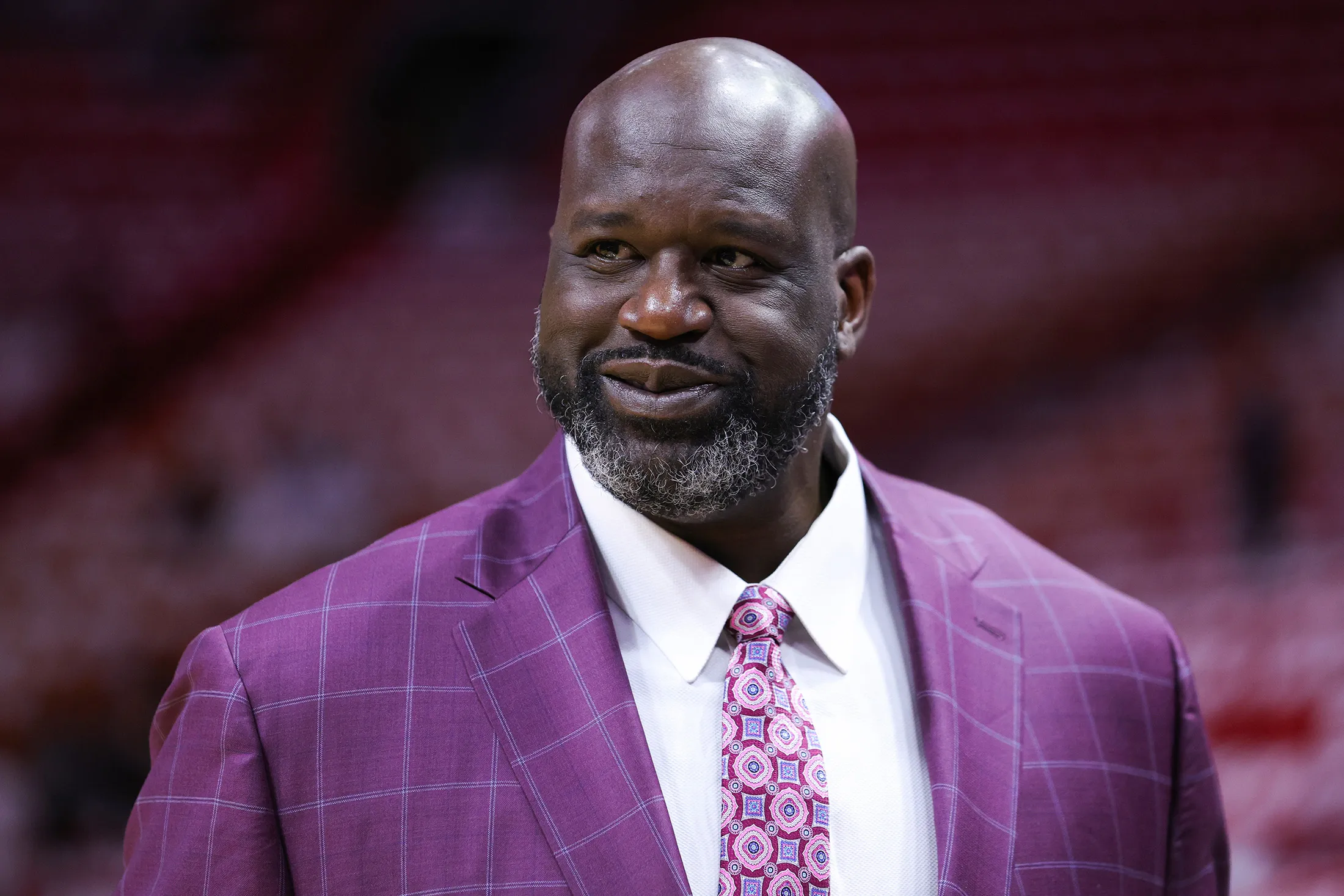

Turki Alalshikh Teases Potential Shaquille O’Neal Project With Cryptic Post on Brief Encounter

Shaquille O’Neal isn’t just a basketball legend, he’s built a business empire that’s just as dominant as his game. Retiring from the game didn’t slow the big guy down. Instead, he turned his focus to investments, and he has his hands on everything, from fast-food chains and shoes to tech startups. He left no stone unturned. “I don’t do anything for monetary purposes… I’m just gonna continue working,” he once said, and that mindset has paid off.

That doesn’t mean Shaq hasn’t had his fair share of missteps. One of his biggest? Passing on Starbucks’ expansion into Black neighborhoods, a move that Magic Johnson capitalized on. But that aside, the Diesel has investments in Papa John’s, The Big Chicken, and Krispy Kreme. Not only that, he also owns gyms and car washes and has stakes in Lyft and Ring. His strategy is simple—he invests in brands he believes in, and they believed in him. And now, it seems that he might be making another big move soon.

Recently, he was spotted with Turki Alalshikh, a Saudi Arabian adviser at the Royal Court. Turki shared a picture and video of himself with Shaq on Twitter, captioning it, “With my brother, the legend Shaquille O’Neal…There are a lot of surprises in the future together.” An intriguing statement indeed. What’s next? Does this mean that Alalshikh is now planning to branch out from combat sports?

Turki has been making waves in boxing, turning Saudi Arabia into a major destination for high-profile fights. He’s helped bring some of the biggest bouts to the region. Tyson Fury vs. Francis Ngannou, Oleksandr Usyk vs. Tyson Fury II, and Artur Beterbiev vs. Dmitry Bivol comes to mind. Moreover, he even tried to get Gervonta Davis on board, though his attempts went in vain.

His ambitions in combat sports are clear, and if he’s teaming up with Shaq, it could mean something huge. With two great minds coming together, whether it’s boxing, basketball, or something unexpected, their collaboration is worth looking out for.

Shaquille O’Neal’s Billionaire Playbook

The path to the billionaire status isn’t easy, but listening to one might help. And guess what the NBA Legend did? He heeded that advice and he couldn’t be happier with the results. When Shaq turned 52, he followed an investment strategy inspired by Amazon founder Jeff Bezos. He once shared, “I heard Jeff Bezos say one time [that] he makes his investments based on if it’s going to change people’s lives. Once I started doing that strategy, I think I probably quadrupled what I’m worth.” And the result? His wealth skyrocketed.

Another smart move of his involves the early investment in Google before its IPO. Apart from these, he owned 155 Five Guys franchises at one point, proving he knows a good deal when he sees one. But his biggest win was backing Ring, the home security company Amazon later acquired for $1 billion. Beyond tech, Shaq has a soft spot for Krispy Kreme, even planning to own 100 locations. He also invested in Uber, another game-changing company.

Today, Shaquille O’Neal’s net worth sits at an estimated $500 million. From basketball courts to boardrooms, Shaq keeps winning—by making smart investments and listening to the right people. If there’s one lesson here, it’s that the right mindset can take you far.

Shaq Wants His Investments to Be Life-Changing

Deals are happening in sports. Plus: Banks and commercial real estate, explained.

In the NBA and in investing, “I realized you can never do anything by yourself,” Shaquille O’Neal said.

Photographer: Megan Briggs/Getty Images North America

Shaquille O’Neal is best known for his spectacular basketball career, but his foray into investing has led him to other high-profile places. The dealmaker is ready to pounce on an NBA team of his own: “Whatever team is available,” he told me this week at the iConnections Global Alts event in Miami. He’d consider buying into the Formula One world, too—“even though I can’t fit in one of those damn cars,” the 7-foot-1 O’Neal said.

He spoke alongside billionaire Jamie Salter, who runs Authentic Brands Group. The firm last year raised hundreds of millions of dollars from investors, including General Atlantic, in a deal that valued it at more than $20 billion.

O’NealPhotographer: John W. McDonough/Sports Illustrated

Authentic Brands agreed to buy the Shaquille O’Neal brand in 2015, and, ever the negotiator, the basketball icon took two-thirds of that money and reinvested it into the firm. “He’s made 20x on his investment in our company,” Salter said.

I asked Shaq whether there were lessons from the NBA he could translate into his business career. “I realized you can never do anything by yourself. You have to trust your teammates,” he said.

“I read a quote one day that said: The greatest leaders are the ones smart enough to have people that are smarter than them,” he said. “So I just surrounded myself with smart people.”

Some more business tricks from O’Neal include sticking to your strategy and finding life-changing moments to invest in. “When I invest, I never want to hear anything monetary. Is it going to change someone’s life, forever? And I’ve made those investments, and I’ve been doing very, very well.”

O’Neal wasn’t the only athlete at the iConnections Miami event—and Salter wasn’t the only person looking to invest heavily in licensing rights. If I had to choose a couple of hot topics in alternative investing this year, that’s one of them. Another group of investors, including HarbourView Equity Partners’ Sherrese Clarke Soares, explained the promise of buying music rights, too. (Clarke Soares’ firm is backed by investing giant Apollo Global Management and has bought catalogs tied to Brad Paisley, Incubus and Luis Fonsi among many others.)

And, of course, there are also direct investments in sports. A group led by John Henry’s Fenway Sports Group inked a major deal this week to invest as much as $3 billion in the PGA Tour. The golf organization’s possible merger with Saudi-backed LIV Golf has tied up bankers and billionaires for several months.

Meanwhile, billionaire Carlyle founder David Rubenstein said he’s buying baseball’s Baltimore Orioles. He paired up with colleagues and friends, including billionaire Michael Arougheti, who runs investment firm Ares, and Michael Bloomberg, the founder and majority owner of Bloomberg News parent Bloomberg LP.

Sports are rising to be among the most active deal markets in the world—and valuations are soaring. Add in the interest in licensing and music rights and you could say the future of investing could be “entertaining.” Shaq could be a big man in that world, too. —Sonali Basak, Bloomberg Television’s global finance correspondent

What the Heck Happened in Regional Banks?

Excuse us if this sounds a bit like déjà vu: An obscure regional bank set off a financial frenzy this week. Now everyone’s talking about regional banks again, and a commercial real estate crisis. Businessweek asked real estate reporters Patrick Clark and Natalie Wong to explain why it matters—and what comes next.

So what exactly happened this week?

On Wednesday, New York Community Bancorp cut its dividend as it worked to set aside more money to offset potential losses on loans backed by office and apartment buildings. It also helped the Hicksville, New York, lender comply with stiffer regulatory requirements imposed after it acquired parts of the failed Signature Bank in 2023. The cut caught investors by surprise and shares plummeted 38%. It also dragged down a closely watched index of regional banks, which saw its largest decline since last year’s crisis.

The shock wasn’t limited to the US either. Japan’s Aozora Bank Ltd.’s share price plunged after it warned of losses tied to US commercial-property bets, especially offices. Frankfurt’s Deutsche Bank AG increased provisions for losses in the sector more than four times the last quarter.

What’s this have to do with real estate? What does it have to do with banks?

Banks, especially regional ones, aggressively financed the commercial real estate sector when borrowing was cheap. Today, interest rates are higher (loans are more expensive), the cost to maintain buildings has skyrocketed and values have declined since the pandemic.

More than $1 trillion in commercial real estate loans are maturing between now and the end of 2025. More than half of that sits with banks. (The rest comes from insurance companies, hedge funds and other sources.)

That’s a big challenge because it means more banks will be forced to confront the discounted values of their loan books—and it could potentially spook investors. NYCB, which has $37 billion in loans backed by apartment buildings and a smaller amount tied to offices, is far from the only exposed lender. Already more vulnerable than the bigger banks, regional banks will be hit harder because they don’t have other revenue streams like credit card lending or investment banking to lean on.

Because offices are far less valuable today, virtually every landlord will pay more for their next loan when their last one matures. Many will decide they’re better off walking away from their property and handing the keys back to the lender. Apartments aren’t exempt from the pain either. Even though demand for housing outweighs supply, many projects were financed at peak values, which no longer exist.

So is this like last year’s rout? Should we be freaking out?

Not yet. Last year, depositors lost confidence in Silicon Valley Bank and First Republic Bank and rushed to pull their money. Today’s issues appear confined to commercial real estate. The basic problem—a looming wall of maturing loans that will be difficult to refinance—applies to most lenders. Few are expecting a sudden wave of distressed fire sales across commercial real estate, but it’s likely that the market will get worse before it gets better. NYCB is unique in that it’s under increased scrutiny and has a large business making loans to New York City apartment landlords, which have been clobbered by a range of issues, including rent regulation.

The next big thing to watch for is how regulators respond to this week’s frenzy and how investors react next time there is bad news on the commercial real estate front. —Patrick Clark and Natalie Wong

Tech Companies Soar

$283 billion

That’s how much Meta Platforms Inc. and Amazon.com Inc. added in market value when trading opened Friday, after delivering quarterly earnings and outlooks that far exceeded Wall Street’s expectations.

Legacy of a Train Derailment

“Will it shorten our lives? How will it affect my grandson and his kids?”

Bob Figley

Owner of Brushville Supply & Hardware

One year after a Norfolk Southern train derailed in East Palestine, Ohio, residents have little information about long-term health impacts. Read the full story here.