❌A CEO Was Forced Out of Her Own Bank — Then Her Legal Team Walked In and Flipped the Script

.

.

The conference room at Meridian Community Bank was filled with an icy tension as board chairman Gerald Wittmann slammed a cardboard box onto the polished mahogany table. The impact shook the surface, rattling coffee cups and sending a shiver through the eight white board members seated around it. Their faces bore satisfied, almost triumphant grins, as if they had just orchestrated a masterpiece. But the box’s contents told a different story—Simone Washington’s MBA diploma, torn at the corner; family photos face down; and her executive of the year award, wrapped in toilet paper like garbage.

The message was unmistakable: You never belonged here.

“Clear out your desk, Simone. You’re done here,” Wittmann said, his voice dripping with contempt.

Security would escort her out, he added coldly. “Make sure she doesn’t steal anything on her way out.”

Janet Holloway, another board member, burst out laughing. “Maybe now we can get someone who actually fits our corporate culture,” she sneered.

Dr. Simone Washington sat frozen. Harvard MBA. CEO for 18 months. Under her leadership, the bank had posted a 23% profit increase. Yet here she was, humiliated in front of 850 employees watching live on Slack. The humiliation was deliberate, calculated, and broadcast to the entire company.

Have you ever been dismissed from something you built by people who never believed you belonged there in the first place?

The live stream viewer count ticked upward: 847, 852, 861 viewers.

Wittmann’s assistant pretended to adjust her laptop as the internal Slack exploded with messages.

“You have 30 minutes before building security locks down for the weekend,” Wittmann announced, checking his Rolex—the same $43,000 watch he bragged about at the Christmas party, inherited from his grandfather.

Simone’s fingers traced the edge of her briefcase. Inside, a titanium legal folder caught the fluorescent light. The embossed letters, KLM Partners, were barely visible, but they were there.

“Gerald,” she said, her voice steady as granite, “our Q3 profits exceeded targets by 23%. What’s the real reason?”

Janet Holloway leaned forward, her smile sharp enough to cut glass.

“Simone, dear, you have to understand. Our clients expect a certain familiarity when they walk through those doors—someone they can relate to.”

The words landed like a slap.

Around the table, knowing glances passed between the older members. Robert Brooks, the newest board member, shifted uncomfortably in his seat.

Wittmann’s phone buzzed. He read the message and chuckled. “The press release is already drafted. Mutual departure to pursue new opportunities. Very amicable.”

“Nothing personal,” Holloway added, adjusting her pearls. “It’s just that some leadership styles don’t translate well in traditional banking.”

Simone pulled out her phone with deliberate calm. Her thumb hovered over a contact labeled simply “JB.” One text: Code seven. Execute immediately.

The message sent across town. Phones buzzed in a corner office suite overlooking the federal courthouse.

“You people always make everything about race,” Wittmann snapped, his mask slipping completely. “Sometimes you’re just not qualified. Period.”

The Slack stream spiked. 1,247 viewers. Screenshots flooded Twitter within seconds. Someone started a hashtag: #Justice4CEO.

Kesha Thompson, a junior analyst working late, stood in the hallway with her phone pressed against the glass door. Her live stream to Instagram attracted her college network—students at Howard, Spelman, and Morehouse. The viewer count climbed: 3,400, 5,800, 8,200.

“Ma’am, I need to escort you out,” said Maurice Jackson, head of security, but he hesitated. Maurice had worked here for 12 years. He remembered when Simone started, how she learned every employee’s name within a week, how she fought to get his daughter an internship.

The building’s PA system crackled to life.

“Attention all employees, please remain in the building for a mandatory all-hands meeting. Repeat, do not leave the premises.”

Simone didn’t flinch. She checked her phone.

“4:59 p.m. This is not a negotiation,” Wittmann’s voice rose. “You’re terminated. Effective immediately. Security will handle the rest.”

Two more guards arrived, flanking Maurice. The room temperature seemed to drop 10 degrees.

Eight board members, three security guards, one assistant still streaming, and Simone Washington alone at the head of the table.

Holloway’s voice turned saccharine. “We’ve already notified the media. Very clean transition. No one has to get messy.”

The threat hung in the air like smoke from a gun barrel.

Kesha’s live stream count hit 12,000. Comments poured in.

“This is discrimination. Save this woman’s job. Where’s the board oversight?”

Someone had already identified Meridian Community Bank. The bank’s main number started ringing—then ringing more. The receptionist downstairs looked confused as line after line lit up red.

Twenty-five minutes.

Wittmann tapped his watch again.

“Then security escorts you to your car. Very simple.”

Simone’s hand rested on her briefcase. The titanium legal folder felt cool against her palm through the leather.

Inside that folder: three weeks of careful documentation, audio recordings, email chains, meeting transcripts—all perfectly legal, all perfectly damning.

But she didn’t open it. Not yet.

Instead, she looked at each board member in turn.

Brooks wouldn’t meet her eyes. He knew this was wrong.

Holloway’s smile faltered under the steady gaze.

Even Wittmann’s confidence wavered.

“You know what’s interesting about traditional banking?” Simone’s voice cut through the tension like a scalpel.

“It’s built on trust, reputation, the belief that institutions will do the right thing.”

She paused, watching the live stream count tick upward on the assistant’s screen. 15,400 viewers—and climbing.

“What happens when people stop believing?”

Maurice shifted his weight. The other guards looked uncomfortable. They’d all seen the comments flooding the live stream. Their own family members were probably watching.

Wittmann’s phone buzzed again. This time he frowned, reading the message. Then another buzz. Another frown.

The bank’s customer service line was lighting up like a Christmas tree.

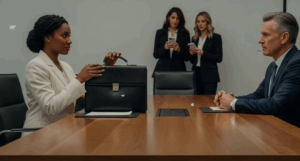

The story had broken on Bloomberg 15 minutes ago, Maya Patel, one of Simone’s attorneys, announced, checking her phone with professional satisfaction.

“Federal discrimination case filed against Georgia community bank. Stock market implications for parent holding companies.”

Meridian wasn’t publicly traded, but its parent holding company was.

The after-hours stock price had already dropped 12% and was falling.

Kesha’s live stream comments exploded with celebration and vindication.

“She had receipts. Three months of planning. Never mess with a smart Black woman.”

The federal case was underway. They were done.

“This is how you fight systemic racism.”

The viewer count climbed past 127,000 as touching stories of workplace discrimination flooded the comments from viewers sharing their own experiences.

Holloway’s voice was barely a whisper.

“What happens if we choose option one?”

Jasmine Burke, KLM Partners’ senior litigation partner, smiled professionally, precisely, and absolutely lethally.

“Dr. Washington returns to work Monday morning with full CEO authority.

You issue a public apology acknowledging the discrimination.

The federal case proceeds, but with recommended reduced penalties for cooperation.”

She paused for effect, savoring the complete reversal of power.

“And you personally undergo 24 months of court-supervised bias counseling at your own expense.”

The humiliation would be exquisite.

Public acknowledgment of guilt.

Court supervision.

Personal accountability broadcast to the world.

“If we choose option two,” Wittmann asked, though he already knew the answer would destroy him.

“Criminal referrals to the Department of Justice Civil Rights Division.

Personal liability for each board member under federal anti-retaliation statutes.

Federal trial with full media coverage.

And Dr. Washington keeps her job anyway under whistleblower protection statutes.”

Simone stood for the first time since the meeting began, rising with the quiet dignity of someone who had transformed victimization into victory.

“I gave you a chance to do this quietly, to treat me with basic professional respect, to acknowledge my qualifications and contributions to this institution.”

Her voice never rose, but power radiated from every word—the power of preparation, justice, and federal law.

“Instead, you chose humiliation. Discrimination. You chose to make this about race when it should have been about results.”

She gestured to her legal team with quiet pride.

“So, I made it about justice. Federal justice—the kind with teeth, precedent, and consequences that transform entire institutions.”

The live stream hit 134,000 viewers.

#FederalJustice began trending nationwide alongside #BlackStories.

“You have 72 hours to decide,” Jasmine announced with final authority.

“Choose wisely. The federal government is watching.”

The legal team filed out as precisely as they entered, leaving behind shell-shocked board members, irrefutable evidence, and the ruins of institutional discrimination.

Simone remained standing, briefcase in hand, looking down at the people who tried to destroy her career—and instead destroyed their own credibility.

“Oh, and Gerald,” she said softly, delivering the final blow with surgical precision.

“You might want to cancel that press release.”

Saturday Morning, 8:47 a.m.

Meridian Community Bank’s executive conference room felt like a war crimes tribunal.

The mahogany table that once symbolized power now served as an altar of accountability.

Gerald Wittmann sat at the head, but his authority had evaporated like morning mist.

Dark circles under his eyes suggested he hadn’t slept.

His normally pristine suit was wrinkled, his silver hair uncombed.

The weight of federal investigation had aged him a decade overnight.

“The Federal Reserve called six times,” he announced at the emergency board meeting, his voice cracking on the word Federal.

“The FDIC wants our loan files.

The Office of the Comptroller scheduled an emergency examination for Tuesday.”

Board member Harrison shuffled through regulatory letters with shaking hands.

They were requesting five years of employment records, personnel files, email archives—everything.

Janet Holloway looked like she’d aged 20 years since Friday evening.

Her usually perfectly coiffed appearance had crumbled into desperate disarray.

“My attorney says we’re looking at personal liability under Section 1983.

Civil rights violations carry mandatory attorney fees.”

The live stream from Friday night had been viewed 2.3 million times across platforms.

Meridian Meltdown reached number three trending on Twitter.

CNN picked up the story.

The Washington Post’s business section led with Georgia Bank Faces Federal Discrimination Charges.

Stock price dropped another 8% in pre-market trading, reported board member Williams, scrolling through his phone with visible distress.

Parent company shareholders were demanding explanations.

Southeastern Financial Group, Meridian’s parent holding company, controlled 12 community banks across three states.

Meridian’s crisis threatened the entire network.

Federal scrutiny spread like cancer through financial institutions.

Wittmann’s phone buzzed.

He glanced at the caller ID.

Atlanta Journal-Constitution.

He let it go to voicemail.

It was the 14th media call since midnight.

“What about our legal options?” Holloway asked desperately.

“Can we challenge the recordings? Claim entrapment?”

Corporate attorney Michael Reynolds, hastily retained at $800 per hour, shook his head grimly.

“Georgia’s one-party consent statute is ironclad.

The recordings are admissible.

The federal case has merit.”

He slid a legal brief across the table.

KM Partners had a 93% success rate in federal discrimination cases.

They’d never lost a banking discrimination case.

The room fell silent except for the ticking of Wittmann’s inherited Rolex—the same watch that counted down Simone’s humiliation just 18 hours ago.

The Justice Department Civil Rights Division had opened a parallel investigation.

Reynolds continued, “Pattern or practice inquiry into lending discrimination.

If they find systemic bias, we’re looking at a consent decree.”

Consent decrees were federal court orders that could control bank operations for decades.

Every loan, every hire, every policy decision subject to government oversight.

Williams pulled up news coverage on his tablet.

Channel 7 interviewed three former employees—all Black, all claiming discrimination.

The optics were catastrophic.

Holloway finished, “My country club friends won’t return my calls.

My daughter’s getting questions at Duke.”

Wittmann’s phone buzzed again.

This time, he recognized the number.

Meridian’s largest commercial client, Davidson Construction.

They held $4.2 million in deposits and a $2.8 million credit line.

He answered reluctantly.

“Good morning, Tom.”

“Gerald, we need to talk,” Tom Davidson’s voice was ice cold.

“Our company has a zero-tolerance diversity policy.

We can’t be associated with institutions facing federal discrimination charges.”

The blood drained from Wittmann’s face.

“Tom, surely we can—”

“We’re moving our accounts to SunTrust Monday morning.

Nothing personal. Just business.”

The line went dead.

Davidson Construction was just the beginning.

Within two hours, three more major clients called with similar messages.

By noon, $12.7 million in deposits were scheduled for transfer.

Reynolds checked his legal pad.

Under the Federal Banking Commission settlement framework, they had until Monday at 5:00 p.m. to respond.

Forty-one hours remaining.

He outlined the mathematics of destruction.

Option two meant federal trial.

Discovery would reveal every board communication, every email, every text message for five years.

Personal depositions under oath.

Media coverage of every proceeding.

Harrison’s face went white.

Personal depositions.

Under federal civil rights law, each board member faced individual liability.

Potential damages ranged from $50,000 to $200,000 per person, plus mandatory attorney fees.

The financial devastation would be personal and total.

Retirement accounts drained.

Houses mortgaged.

Reputations destroyed.

The Department of Justice investigation was separate.

Criminal referrals possible under 18 USC Section 242.

Deprivation of rights under color of law.

If prosecuted, potential imprisonment.

Federal prison.

Orange jumpsuits.

The ultimate humiliation for people who’d built their identity on social status and respectability.

Holloway’s voice trembled.

“What about option one?”

Reynolds read from the settlement terms.

Dr. Washington’s immediate reinstatement as CEO with expanded authority.

Three-year contract protection against termination without federal oversight approval.

$2.3 million settlement donated to community financial literacy programs.

Mandatory unconscious bias training for all employees.

Quarterly sessions for 24 months.

Board restructuring requiring 40% minority representation within six months.

Annual diversity audits by independent federal contractors.

The requirements would transform Meridian completely.

Every hiring decision scrutinized.

Every promotion reviewed.

Every policy evaluated through an equity lens.

“And personal consequences?” Wittmann asked, dreading the answer.

Public apology acknowledging discriminatory behavior.

Court-supervised bias counseling for 24 months at personal expense.

Resignation from all community leadership positions.

The social humiliation would be exquisite.

Wittmann served on four nonprofit boards, chaired the Chamber of Commerce, belonged to three exclusive clubs.

All of it was gone.

Williams looked up from his tablet.

The story had gone national.

Bloomberg, CNBC, Wall Street Journal.

Someone leaked the settlement terms.

The media firestorm grew by the hour.

Business reporters dissected the case.

Legal analysts explained federal banking law.

Civil rights leaders called for systemic change.

Justice for Simone had generated 847,000 tweets.

Her story resonated across corporate America, touching stories of discrimination inspiring other victims to speak out.

Wittmann’s phone showed 37 missed calls.

Regional media, national outlets, financial analysts, shareholders demanding explanations.

The avalanche of accountability accelerated.

“There’s something else,” Reynolds said grimly.

KM Partners filed a motion for expedited discovery.

If option two was chosen, depositions would begin next week.

Seven days to prepare for legal interrogation under oath.

Federal prosecutors asking pointed questions about racial bias.

Every statement recorded, transcribed, potentially criminal.

Holloway broke first.

“I can’t do this. I won’t go to prison for Gerald’s discrimination.”

“My discrimination?” Wittmann exploded.

“You made the cultural alignment comment.

You called the meeting.

You pushed the termination.”

The board fractured in real time.

Eighteen months of unified discrimination crumbled into desperate self-preservation.

Harrison stood abruptly.

“I’m calling for an emergency vote.

Full acceptance of option one.

All in favor?”

Four hands rose immediately: Williams, Harrison, and two others who’d remained silent during Friday’s debacle.

Gerald Harrison asked Janet.

Holloway’s hand trembled as it rose.

All eyes turned to Wittmann.

The man who’d orchestrated Simone’s humiliation now faced his own moment of accountability.

His phone buzzed again.

Another major client.

Another account closure.

Another step toward institutional collapse.

“We need a unanimous vote,” Reynolds explained.

Federal settlement required full board approval.

The silence stretched like a taut wire.

Wittmann stared at the cardboard box still sitting on the credenza—the same box he’d used to humiliate Simone.

The wilted plant inside had died completely.

Outside, protesters had gathered.

Word spread through social media Saturday morning.

Two hundred people holding signs: Justice for Dr. Washington and Banking While Black Should Not Be a Crime.

Local news crews filmed the demonstration.

The visual optics were devastating.

A community bank under siege for discriminating against its own CEO.

Wittmann’s voice was barely a whisper.

“Yes, I vote yes.”

The decision was unanimous.

Option one accepted.

Reynolds made notes on his legal pad.

“I’ll contact KLM Partners immediately.

Dr. Washington returns to work Monday morning at 9:00 a.m.

Press conference scheduled for 2 p.m. with full board apology.”

As board members filed out like defeated generals, Wittmann remained alone in the conference room.

The mahogany table that once represented his power now served as a reminder of its limits.

Monday Morning, 8:58 a.m.

Dr. Simone Washington walked through Meridian Community Bank’s glass doors for the first time since Friday’s attempted termination.

The difference was seismic.

Maurice Jackson, head of security, stood at attention.

“Good morning, Dr. Washington. Welcome back.”

His respect was genuine now—not the conflicted difference of a man caught between conscience and orders.

Every employee in the lobby turned to watch.

Some applauded quietly; others nodded with satisfaction.

Kesha Thompson waited by the elevator, her phone recording discreetly—not for viral content this time, but for historical documentation.

“How does it feel to be back?” she asked.

“Like coming home,” Simone replied simply. “But better, because now everyone knows where they stand.”

The elevator rose to the executive floor.

The same hallway where she’d been humiliated now felt transformed.

Federal oversight changed everything—not just policies, but the very air people breathed.

At 2:00 p.m. sharp, the press conference began.

Eight board members sat behind a banner reading Meridian Community Bank: Commitment to Equity and Justice.

The irony was intentional.

Gerald Wittmann stepped to the podium, his prepared statement shaking in his hands.

The man who dismissed Simone with casual cruelty now faced public accountability.

“On behalf of Meridian Community Bank’s board of directors, I offer our sincere apology to Dr. Simone Washington for discriminatory treatment that violated both her dignity and federal law.”

His voice cracked on federal law.

Behind him, Janet Holloway stared at her hands, unable to meet the cameras.

“We acknowledge that our actions reflected unconscious bias and systemic failures that have no place in modern banking.”

Dr. Washington’s leadership had driven unprecedented growth: 23% profit increase, expanded community lending, and innovative financial literacy programs.

The admission of competence made their discrimination even more damning.

They didn’t fire her for performance.

They fired her for existing while Black.

“Effective immediately, Meridian implements comprehensive reforms: mandatory bias training for all employees, independent diversity audits, board restructuring to ensure minority representation reflects our community.”

Channel 7’s reporter raised her hand.

“Mr. Wittmann, do you accept personal responsibility for the discrimination?”

Wittmann’s pause stretched uncomfortably.

“Yes. My actions and words contributed to a hostile environment. I take full responsibility.”

The words tasted like ashes, but federal oversight demanded truth.

Three months later, the transformation was measurable.

Meridian’s workforce diversity increased 37%.

The new minority board members brought fresh perspectives and community connections.

Marcus James, no relation to former board member Robert, chaired the newly created Equity Committee.

Dr. Amara Williams, former NAACP regional director, oversaw hiring practices.

Both appointments were suggested by Simone and approved unanimously by the reformed board.

The bank’s financial performance told its own story.

Customer deposits grew by $42 million.

New accounts from minority communities who’d never trusted Meridian before.

Community leaders recommended the bank specifically because of its equity commitment.

“When institutions demonstrate real change,” Simone explained to Harvard Business Review, “communities respond.”

Loan approval rates for minority applicants now exceeded industry averages—not through lowered standards, but through eliminating bias.

The federal settlement’s $2.3 million funded three community initiatives: financial literacy programs in underserved neighborhoods, small business development loans, and college banking education partnerships with historically Black colleges.

Kesha Thompson, promoted to Community Outreach Coordinator, managed the programs.

Dr. Washington had turned her discrimination into community empowerment.

“That’s transformational leadership,” she told local news.

The unconscious bias training extended beyond legal requirements.

Monthly workshops explored microaggressions, inclusive communication, and equity in financial services.

Not corporate theater, but genuine cultural transformation.

Employee satisfaction surveys showed remarkable improvement.

The anonymous comment system implemented to prevent future discrimination revealed testimonials about improved workplace culture.

“I can finally be myself at work,” one employee said.

“Leadership actually listens now.”

“We’re serving communities we ignored before.”

Gerald Wittmann resigned from all community leadership positions as required.

His court-supervised bias counseling sessions were private, but courthouse reporters noted his regular Tuesday appointments.

The man who wielded power casually now answered to federal oversight.

Janet Holloway left Georgia entirely.

A quiet resignation followed by relocation to her daughter’s city.

Some failures demand geographic distance for healing.

But this story isn’t about their redemption.

It’s about Simone’s courage, strategic thinking, and refusal to accept discrimination as inevitable.

It’s about using federal law as a shield, and community support as a sword.

Sometimes the most powerful revolutions happen not in the streets, but in boardrooms, courtrooms, and anywhere someone refuses to accept “that’s just how things are.”

Simone concluded her keynote speech at the National Banking Convention:

“Your voice matters in these Black stories of resilience and transformation.

Share your own experiences with workplace discrimination in the comments below.

Your story might inspire someone else to fight back.

Together, we can create systemic change.

One documented case of courage at a time.”

She smiled.

“Hit that subscribe button for Black Soul Stories and turn on notifications.

These real-life stories of justice, intelligence, and quiet power need to be heard across every platform, every community, every boardroom where change is still needed.

Because when we share these touching stories of triumph over discrimination, we don’t just inform—we inspire the next generation of leaders who refuse to be silent when faced with injustice.