Bank Manager Tosses CEO’s Father’s ID — A $5B Deal Dies on the Spot

.

.

The Marble Floor

I. The Incident

Pick it up, old man. People like you need to learn respect in my bank.

The ID card skidded across the marble floor, spinning out from the manager’s fingertips. The lobby of Westlake National Bank froze. The only sound was the echo of the plastic against stone.

Thomas Reynolds, seventy, stood motionless. His charcoal suit was pressed, his silver tie clip gleamed, his Italian shoes reflected the harsh overhead lights. He had spent decades entering spaces that questioned his belonging. His armor was not vanity, but necessity.

He bent slowly, knees crackling, and reached for the license. The bank manager, Bradley Foster, shifted his polished shoe closer to Thomas’s trembling hand—a deliberate gesture. Thomas straightened, his face composed, and placed the ID back on the counter.

Across the lobby, Malcolm Reynolds watched. He was Thomas’s son, CEO of Horizon Innovations, and today he was finalizing a $5 billion merger with NextGen Financial Group—Westlake’s largest client. Malcolm’s phone vibrated with emails, but his attention was on his father. The humiliation burned into memory.

No one spoke. The clock ticked. A choice formed in Malcolm’s mind.

II. The Test

Thomas approached the information desk. “I’d like to add my son as a signatory on my accounts.”

Bradley Foster eyed him, calculating: outdated suit, probable fixed income, not worth his attention. He signaled a junior associate.

Annette, help the gentleman.

Thomas’s voice was clear. “I requested the manager. These are premium accounts with complex changes.”

Foster’s eyebrows rose. He approached, smile tight. He checked Thomas’s accounts—respectable balances, but not impressive.

“What can I help you with today?” Foster said, voice louder than necessary.

“I need to add my son as a signatory on all accounts.”

Foster nodded, explaining basic procedures Thomas already knew. “We’ll need to verify your identity first. Regulations, you understand?”

Thomas produced his driver’s license. Foster pinched it, examining it with exaggerated scrutiny, turning it over multiple times as if suspecting forgery.

“This seems…” Foster let the sentence hang, implying doubt.

Thomas folded his hands, patient. The temperature in the room dropped as Foster released the ID, letting it fall.

“I’ll need valid identification, sir,” Foster said, voice carrying. Thomas pointed. “You just dropped my valid identification.”

Foster shrugged. “If you need assistance bending down…”

Malcolm’s instinct screamed to intervene, but he knew his father. Thomas bent, wincing, picked up the ID, and placed it back on the counter.

“This identification is valid.”

Foster picked it up between two fingers, as if contaminated. “The address seems inconsistent with our records.”

“I’ve lived at 1842 Maple Avenue for thirty years,” Thomas replied.

A young teller watched, discomfort on her face. Malcolm stepped forward, his tailored suit costing more than Foster’s monthly salary.

Foster noticed, assessing the fabric, the stride. “I’ll be with you shortly, sir,” he said dismissively.

“I’m with him,” Malcolm said.

Foster’s expression shifted. “Your father?” Surprise poorly disguised.

“Yes,” Malcolm replied.

Foster’s eyes darted between them. “You don’t look like you’re from the same…”

He stopped, the implication hanging in the air. Thomas remained still. Malcolm’s jaw tightened. “From the same what, exactly?”

Foster busied himself with his tablet. “We’ll need additional verification for security purposes. For certain accounts, it’s bank policy.”

“Certain accounts?” Malcolm asked.

Foster ignored him. “A second form of identification, please.”

Thomas produced his passport. Foster examined it theatrically. “I’ll need to see a credit card and social security verification.”

Thomas extracted his social security card and platinum AMX. Foster held each to the light. Customers watched the excessive process.

“The signature appears inconsistent,” Foster claimed.

“It’s identical,” Thomas said quietly.

“Perhaps we should try again.” Foster crumpled the form and tossed it toward the trash. It missed, landing on the floor.

“You dropped something,” Foster smirked.

Thomas didn’t move. Malcolm stepped forward, but Thomas raised his hand slightly—a signal only his son would recognize.

Stop. Let me handle this.

“I’ve been a customer here for thirty-five years,” Thomas said. “I’d like to speak with your supervisor.”

“I am the senior manager on duty. There’s no one else available today.”

Thomas took a measured breath, calculating options. Malcolm watched, seeing not an old man humiliated, but a fortress of dignity under siege.

A security guard approached, positioning himself closer to Malcolm than Foster. “Is there a problem here?”

“Ask him,” Malcolm replied.

“Just following security protocols. Some people have difficulty understanding our procedures,” Foster said.

Thomas signed the form again, perfect penmanship. Malcolm’s phone buzzed—a text from Clare Davidson, NextGen’s CEO.

Ready to sign merger docs tomorrow. $5B wire transfer through Westlake National.

Malcolm’s fingers tightened. Five billion reasons to walk away battled with one compelling reason to stay.

Foster finally nodded. “This will do, I suppose.” He processed the change with deliberate slowness, explaining basic banking concepts as if speaking to someone unfamiliar.

Malcolm stepped away, answering his vibrating phone.

“Malcolm Reynolds.”

“Malcolm, it’s Clare. Just confirming tomorrow’s signing. Everything on track?”

“Yes, everything’s set,” Malcolm replied, voice carrying. “The $5 billion transfer through Westlake National has agreed.”

“Excellent. Any concerns about the institution?”

Malcolm watched Foster making Thomas initial unnecessary forms. “I’m developing some concerns. Let me call you in ten minutes.”

He returned to his father’s side as Foster finished. “All done, Mr. Reynolds. Try not to drop your ID next time.”

Thomas collected his identification. “Thank you for your assistance.”

Malcolm and Thomas walked toward the exit. The security guard watched, hand resting unnecessarily on his holster.

“You didn’t have to let him treat you that way,” Malcolm said quietly.

“I’ve navigated worse,” Thomas replied. “Some battles aren’t worth fighting.”

Malcolm stopped at the glass doors, looking back at Foster, who was already greeting a white customer with a warm smile.

“This one might be,” Malcolm said.

Thomas studied his son’s expression—the same look he’d had as a child facing injustice on the playground, now backed by corporate power.

“What are you thinking?”

“That some lessons need teaching,” Malcolm said. “I need to make a call.”

III. The Power Play

They stepped into Malcolm’s waiting town car. Thomas sat silently as Malcolm pulled out his phone.

“This isn’t necessary,” Thomas said. “Not for an old man’s pride.”

“It’s not about pride. It’s about patterns,” Malcolm replied, dialing.

Malcolm called Clare Davidson. “Clare, we need to discuss changing financial institutions for the merger.”

“What? Why?”

“Westlake’s manager displayed unacceptable behavior toward my father. I won’t direct $5 billion through an institution with that culture.”

Clare hesitated. “Changing banks now would delay the merger by weeks. Shareholders expect an announcement Monday.”

“Then we announce a delay,” Malcolm replied. “I’m willing to jeopardize the deal over this.”

Clare asked to speak with Thomas. “Mr. Reynolds, I’m so sorry. Was it as bad as Malcolm describes?”

“It was exactly as he describes,” Thomas confirmed. “But I’m not asking him to change anything for me.”

“It’s not just about you, Dad,” Malcolm said. “It’s about every person who walks in there looking like us.”

Malcolm called his CFO, Alex Patel. “Alex, I need alternatives to Westlake for the merger transaction.”

“What? Changing now means renegotiating terms, new due diligence. The board will—”

“Foster is just one manager.”

“One manager reflects the culture they tolerate. Find me options by tonight.”

Thomas watched his son work, remembering decades of indignities building his business. Loan applications denied, funding unavailable when he appeared in person after phone approvals.

“What’s your plan?” Thomas asked.

“Education,” Malcolm replied, calling his head of legal affairs.

Inside the bank, Foster continued his day, unaware of the storm. He laughed with a colleague about difficult customers. His phone rang—a call from regional director Elaine Torres.

“Foster, we’ve received a serious complaint about an incident today involving Thomas Reynolds. I need details immediately.”

“Nothing serious. Elderly customer confused about our procedures. I handled it professionally.”

“The complaint suggests otherwise. I want a full report on my desk by morning. The board chairman is asking questions.”

Foster drafted an email, painting himself as professional dealing with a difficult customer. He hit send, dismissing the matter.

Malcolm met with his executive team. “Westlake National is off the table for our banking needs,” he announced. His CFO presented alternatives—each would delay the merger by weeks. NextGen was nervous.

“Principles matter,” Malcolm said.

Across town, Clare fielded calls from shareholders. She arranged an emergency board meeting. “Malcolm Reynolds is threatening to walk over an incident at Westlake National.”

“What kind of incident justifies risking $5 billion?” the chairman demanded.

“The kind that reveals character,” Clare replied.

Thomas called Malcolm late that night. “Son, I appreciate your stand, but this merger is too important. Don’t derail it over an old man’s dignity.”

“It’s not just about dignity, Dad. It’s about systems that enable people like Foster. Sometimes change requires leverage.”

“You’re risking everything you’ve built.”

“I’m building on what you taught me. Integrity isn’t situational.”

IV. The Reckoning

Morning arrived crisp and clear. Foster entered regional headquarters, ready with explanations. The receptionist looked up. “Mr. Foster, they’re waiting for you in the boardroom.”

Inside, six executives sat in perfect stillness. No one smiled. No one offered coffee.

Torres spoke first. “We’re addressing a complaint about your conduct involving Thomas Reynolds.”

Foster waved dismissively. “Elderly customer needed extra verification. Perhaps he was confused.”

The chairman slid a folder toward Foster. “Thomas Reynolds, founding investor in Westlake National, holding significant shares. Owner of Reynolds Construction, which built our headquarters.”

“I wasn’t aware,” Foster began.

“Clearly,” Torres interrupted. “But that’s not why we’re here.”

Across town, Malcolm entered NextGen’s boardroom. Clare introduced him to concerned board members.

“Malcolm needs to explain why he’s jeopardizing our merger over a banking issue,” Clare said.

Malcolm described the incident calmly, omitting his father’s prominence. “I won’t partner with companies that enable discriminatory behavior.”

“Is this worth delaying a $5 billion deal?” the chairman asked.

“Values aren’t situational. What happened to my father happens daily to people without my platform. If I don’t use my position to address it, what’s the point?”

Clare nodded. “We’ve built this merger on shared values. If those values don’t extend to how we select partners, what are they worth?”

Back at Westlake, the security director entered, placing a USB drive on the table. The screen flickered, showing security footage of Foster dropping Thomas’s ID, positioning his foot, dismissing valid identification. Every word, every gesture captured.

“This is standard footage,” Torres explained. “What we’re seeing doesn’t align with your explanation.”

“You’re misinterpreting. The ID slipped. I was following protocols.”

The chairman opened another file. “We pulled records of your verifications for the past year. Interesting patterns emerge.”

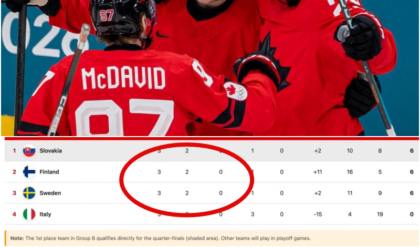

Color-coded data revealed inconsistent protocols based on race and age. White customers, average time: 4.2 minutes. Black customers: 12.8. Elderly minorities: 18.3.

The chairman continued. “Thomas Reynolds isn’t just a premium customer.”

Malcolm revealed his father’s role in banking oversight. “He’s been documenting discriminatory patterns for years. Yesterday’s incident will feature in his congressional testimony.”

NextGen’s board members exchanged glances. “This puts us in a difficult position,” the chairman admitted.

“It puts us in the right position,” Clare countered. “Do we want to be on the right side when this goes public?”

Malcolm stood. “I’m not using this as leverage. I’m making a choice about our partners. You’re free to make yours.”

The board voted to support Malcolm’s position.

At Westlake, Foster attempted damage control. “I can call them, apologize, explain it was a misunderstanding.”

“It’s far beyond that,” Torres replied. “You’re suspended with pay.”

V. Change at Scale

Thomas reviewed footage of similar tests at banks nationwide, preparing testimony that would shake the industry. The board terminated Foster’s employment unanimously. The chairman called Malcolm, apology and damage control in his voice.

“Mr. Reynolds, on behalf of our institution, I offer our deepest apologies. Mr. Foster’s behavior violated every standard we uphold.”

“Claims and reality often differ,” Malcolm replied.

“We’re implementing comprehensive changes to training and accountability.”

Malcolm listened, making no commitments.

NextGen’s board voted to delay the merger and reassess partnerships based on inclusion and respect. The statement didn’t mention Westlake, but analysts connected the dots. Headlines ran: “Banking Discrimination Claims Halt Major Merger.”

Thomas received calls from fellow committee members. “Your testimony now has a powerful example,” Senator Harris said.

Regulators began drafting new guidelines. Malcolm established clear conditions for continuing with Westlake: mandatory bias training, independent audits, financial support for community banking. The bank’s board, pressured by shareholders, agreed.

Foster hired attorney Stephanie Webb, claiming wrongful termination. She built a defense around entrapment. Westlake’s legal team dismissed the claim, providing documentation of Foster’s consistent behavior.

Thomas invited Foster to meet privately. Foster arrived, expecting confrontation. Instead, Thomas calmly reviewed banking records.

“I’ve been documenting these patterns for decades,” Thomas explained. “This isn’t about punishing you. It’s about changing systems.”

Foster listened, defensive at first, then uncomfortable as he recognized himself in dozens of similar interactions.

“I never considered myself prejudiced,” Foster admitted.

“Few do,” Thomas replied. “That’s why evidence matters.”

Other banks examined their practices, fearing scrutiny. Malcolm connected CEOs with diversity consultants. Institutions that acknowledged problems before scandals thrived. Social responsibility metrics gained financial implications.

Thomas testified before Congress, focusing on patterns rather than individuals. “These aren’t isolated incidents. They’re systems that permit bias without accountability.”

Regulatory agencies began mystery shopper testing, public reporting of service quality audits.

Foster, unable to find work in banking, enrolled in sociology, eventually speaking at industry events. “I didn’t recognize my own patterns until seeing them from the outside,” he said. “Systems don’t just perpetuate themselves. People like me perpetuate them through daily actions we don’t examine.”

Westlake implemented industry-leading bias training and anonymous service testing. Their chairman invited Thomas to join their board. Thomas declined, recommending qualified candidates from underrepresented backgrounds.

Malcolm established a financial literacy foundation, funded by the merged company’s profits. Clare Davidson joined its board.

“Financial inclusion requires more than access,” Malcolm said. “It requires equal treatment.”

VI. Legacy

The Reynolds standard became a benchmark for service quality. Thomas prepared to retire from the ethics committee, receiving applications from young professionals—including Foster’s daughter.

One year later, Thomas and Malcolm met for dinner. The maître d’, unaware of their prominence, greeted them with easy professionalism.

“Some things are changing,” Malcolm observed.

“Slowly,” Thomas agreed, “but meaningfully.”

They discussed industry transformations. Malcolm showed Thomas letters from people sharing similar experiences, thanking him for his advocacy.

“I spent decades tolerating what I should have challenged,” Thomas admitted. “I wonder how much could have changed sooner.”

“You were documenting, building evidence,” Malcolm countered. “That patience made the change permanent.”

Their server approached. “Gentlemen, your dinner has been paid for anonymously.”

Malcolm raised an eyebrow. “Can we thank our benefactor?”

The server gestured toward a corner table where Foster sat with his daughter. Foster raised his glass in acknowledgement before leaving.

“Accountability without redemption is just punishment,” Thomas said. “Real change needs both.”

Emma approached. “Mr. Reynolds, I wanted to thank you. Your work inspired my thesis. I start at the banking ethics committee next month.”

Thomas smiled. “The next generation improves on our work.”

After she left, they finished dinner in comfortable silence. Thomas reflected on his journey—from young entrepreneur facing obstacles to advocate for systemic reform.

“The most powerful response to disrespect isn’t anger,” he said. “It’s strategic change.”

Malcolm considered his father’s wisdom. “You never taught me to fight back directly.”

“I taught you to build instead. Fighting tears down. Building creates new realities.”

They stepped into the cool evening air. Across the street, a new bank branch displayed Thomas’s quote: Equal respect shouldn’t depend on knowing someone’s importance.

Malcolm read it, then looked at his father. “Your words, their choice.”

“That’s how you know it’s real change.”

They walked together, two generations who transformed personal indignity into industry-wide reform—not through vengeance, but strategic persistence and patient influence.

Was it worth it? Malcolm asked.

“Ask me in another generation, when no one remembers it was ever different.”

Dignity doesn’t demand revenge. It requires creating systems where disrespect can’t thrive.

End of story.