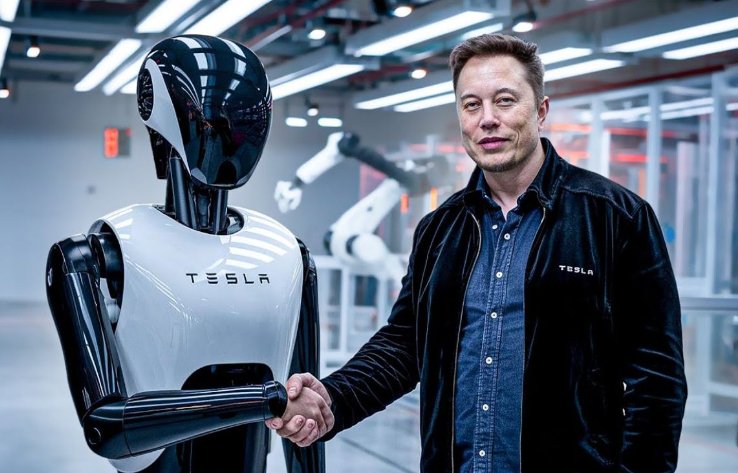

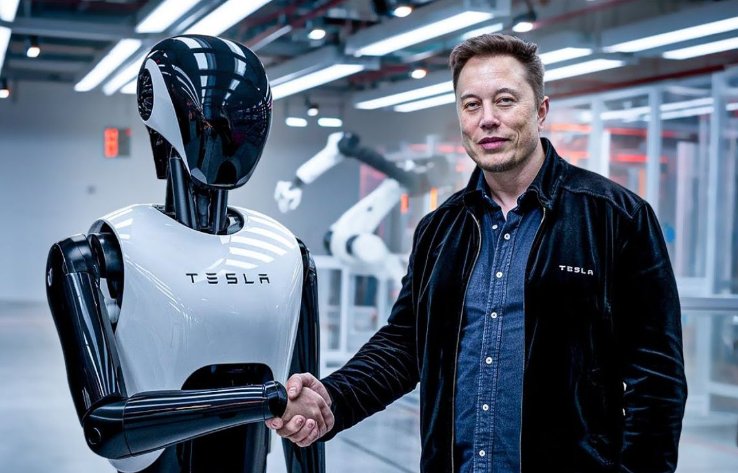

Elon Musk’S Bold Claim Rocks Markets: Tesla Loses $70 Billion As He Claims ‘Everyone On Earth Wants A Muskbot’

In the fast-paced world of technology and innovation, few figures command as much attention as Elon Musk. Known for his audacious ideas and bold statements, Musk has once again made headlines—but this time, it came at a significant cost to Tesla. The electric vehicle giant saw its market valuation plummet by a staggering $70 billion after Musk confidently declared that “everyone on Earth wants a Muskbot.” While the statement was classic Musk—visionary yet provocative—it left investors questioning the implications for Tesla’s future and sparked widespread debate about the balance between ambition and accountability.

The Statement That Shook the World

During a recent public appearance, Elon Musk introduced the concept of the “Muskbot,” a futuristic AI-driven assistant designed to revolutionize human productivity and lifestyle. Musk described the Muskbot as “the ultimate companion for humanity,” capable of performing tasks ranging from household chores to advanced problem-solving. His claim that “everyone on Earth wants a Muskbot” was met with both fascination and skepticism.

While the idea aligns with Musk’s reputation for pushing boundaries in artificial intelligence and robotics, it also raised concerns among Tesla shareholders. Many interpreted the statement as a potential shift in focus away from Tesla’s core business—electric vehicles—and toward unproven ventures like the Muskbot. This perceived diversion of attention and resources sent shockwaves through the stock market, resulting in Tesla’s valuation dropping by $70 billion overnight .

Why Did the Market React So Strongly?

Tesla’s stock has always been closely tied to Elon Musk’s public statements and actions. As one of the most influential figures in the tech and automotive industries, Musk’s words carry immense weight. However, this influence can be a double-edged sword. When he speaks about futuristic projects or makes sweeping claims, it often triggers volatility in Tesla’s stock price.

Several factors contributed to the sharp decline:

1. Uncertainty About Resource Allocation : Investors worry that Musk’s enthusiasm for new ventures, such as Neuralink, SpaceX, and now the Muskbot, could divert critical funding and attention away from Tesla’s primary mission of accelerating sustainable energy adoption.

2. Market Fatigue with Overpromising : Musk is no stranger to making bold predictions, some of which have yet to materialize. For example, promises about full self-driving capabilities and robotaxis have faced delays, leading to growing impatience among shareholders.

3. Concerns About Brand Dilution : Tesla’s brand identity is deeply rooted in its leadership position in EV innovation. Any suggestion of diversification into unrelated fields, like personal AI assistants, risks diluting the company’s core appeal.

4. Broader Economic Context : With global markets already jittery due to inflation, interest rate hikes, and geopolitical tensions, Musk’s statement added fuel to the fire, amplifying investor anxiety.

The Muskbot Vision: Revolutionary or Unrealistic?

Despite the backlash, Musk’s vision for the Muskbot is undeniably intriguing. If realized, such a product could redefine how humans interact with technology, much like smartphones did two decades ago. Imagine an AI-powered assistant that not only automates mundane tasks but also learns and adapts to individual preferences, becoming an indispensable part of daily life.

However, turning this vision into reality presents numerous challenges:

– Technological Hurdles : Developing a truly autonomous, multi-functional AI assistant requires breakthroughs in machine learning, natural language processing, and robotics—fields that are still in their infancy.

– Ethical Concerns : The prospect of widespread adoption raises questions about privacy, data security, and the societal impact of relying heavily on AI companions.

– Financial Risks : Bringing the Muskbot to market would likely require billions in research and development, potentially straining Tesla’s balance sheet further.

For now, the Muskbot remains a concept rather than a concrete plan. Yet, Musk’s ability to generate buzz around futuristic ideas underscores his unique talent for capturing the public’s imagination—even if it comes at a financial cost.

Lessons for Investors and Entrepreneurs

The fallout from Musk’s latest proclamation serves as a reminder of the delicate balance between visionary thinking and practical execution. For entrepreneurs, it highlights the importance of aligning bold ideas with clear strategies to maintain stakeholder confidence. For investors, it underscores the need to critically evaluate long-term prospects versus short-term hype.

Tesla’s $70 billion loss may seem alarming, but history shows that Musk’s companies often recover from setbacks. After all, Tesla itself has weathered numerous crises before emerging stronger. Whether the Muskbot becomes the next big thing or fades into obscurity, one thing is certain: Elon Musk will continue to challenge norms, disrupt industries, and keep the world watching.

Elon Musk’s assertion that “everyone on Earth wants a Muskbot” exemplifies his knack for sparking conversations about the future. However, it also demonstrates the risks of overpromising in an era where markets demand transparency and accountability. As Tesla navigates this latest turbulence, the incident serves as a cautionary tale about the intersection of ambition, innovation, and investor sentiment.

Will the Muskbot evolve from a provocative idea into a transformative product? Only time will tell. But for now, Tesla’s $70 billion valuation drop stands as a testament to the profound impact of Elon Musk’s words—and the unpredictable nature of investing in his vision.