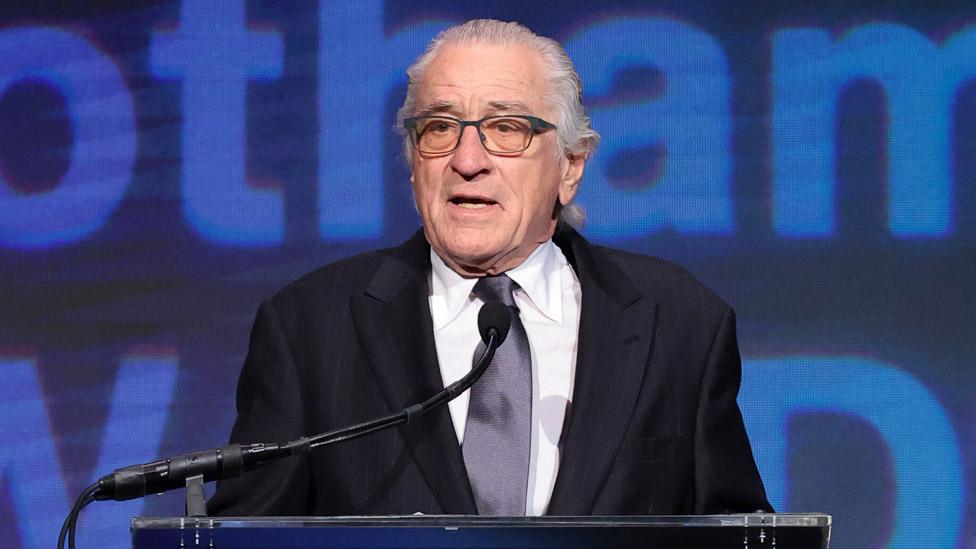

Robert De Niro Demands “Huge Tax Discount” from New York Despite Supporting 4% Wealth Tax

Legendary actor Robert De Niro is no stranger to the spotlight—on screen or in the public arena. But this week, the Oscar-winner found himself at the center of a heated debate over New York’s new “public wealth tax,” which levies an additional 4 percent on residents with assets exceeding $10 million.

De Niro, known for both his cinematic contributions and outspoken political views, expressed frustration at the prospect of paying millions more to the city he famously calls home. In a recent interview, he argued that his decades-long support of New York’s arts, culture, and economy should entitle him to a “huge discount” on his taxes.

“I’ve given so much to the city—jobs, tourism, philanthropy, you name it. I think I deserve a break,” De Niro complained, referencing his investments in restaurants and film festivals that have become staples of the city’s cultural landscape.

The Wealth Tax Backlash

The “public wealth tax,” passed by the New York legislature earlier this year, aims to address income inequality and boost funding for public services. For the city’s wealthiest, including celebrities like De Niro, the new law means millions in additional annual payments to the state coffers.

While De Niro’s call for a tax break may resonate with some fellow high earners, critics were quick to point out the irony: De Niro has long endorsed progressive policies and candidates who champion higher taxes on the rich.

Social media was ablaze with pointed responses:

“This is what you endorsed and voted for, Bob. Own it,” wrote one commentator, echoing the sentiment of many who see De Niro’s frustration as a case of political chickens coming home to roost.

A City Built by Its Residents—Rich and Poor

De Niro’s argument that his contributions to New York should earn him special treatment has sparked a broader conversation about fairness, privilege, and civic responsibility. Supporters say that cultural icons and business leaders do play a vital role in the city’s vibrancy. Detractors counter that tax laws must apply equally, regardless of fame or philanthropy.

City officials, meanwhile, have shown little interest in carving out exceptions for celebrities. “Everyone benefits from a thriving New York,” said one council member. “Everyone should contribute their fair share.”

The Bottom Line

As the “public wealth tax” takes effect, De Niro—and thousands of other high-net-worth New Yorkers—will see their tax bills rise. Whether the actor’s complaints will inspire legislative reconsideration or simply serve as fodder for public debate remains to be seen.

For now, the message from critics is clear:

If you championed these policies, it’s time to live by them.

And as New York’s richest weigh their options, the city’s coffers—and its residents—will be watching closely.