Banking While Black: Humiliated, Profiled, and Denied — The Day a Black CEO Froze the System by Saying ‘I Own This Damn Bank!’

The marble lobby of First National Bank was supposed to represent stability, trust, and prestige. But on one unforgettable afternoon, it became ground zero for the most viral, catastrophic customer service failure in banking history — and the reckoning that followed would shake the financial world to its core.

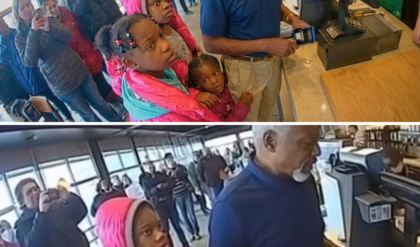

It began with practiced contempt. Brad Mitchell, a veteran teller, didn’t bother to hide his disdain as Kesha Thompson approached his counter. “Excuse me, what are you doing here? The welfare office is three blocks down,” he sneered, slicing through the lunch hour buzz. The crowd turned, phones surreptitiously raised as the scene unfolded. Kesha, a Black woman in a tailored suit, was met not with professionalism, but with suspicion and open hostility. “This is a private banking institution, not a check cashing service,” Brad declared, voice loud enough to ensure every marble column echoed with his bias.

Kesha placed her withdrawal slip on the counter with dignified calm. “I’d like to withdraw $25,000 from my account, please.” Brad’s laughter was sharp, mocking, and toxic. “Lady? That’s more money than most people see in a year. What kind of game are you trying to run?” He crumpled her slip, barely glancing at her platinum banking card and government-issued ID. “Anyone can get fake IDs these days,” he scoffed, waving her credentials like evidence in a trial.

The crowd swelled. Maya Patel, a freelance journalist, was already live-streaming the encounter. Comments poured in: “This is disgusting. Call the news. Where is this bank?” The hashtag #bankingwhileblack began trending in real time.

Susan Martinez, the branch supervisor, joined the fray, her body language aligning instantly with Brad. “Ma’am, we have strict protocols for high-dollar transactions, especially from certain account types,” she said, the phrase “certain account types” hanging in the air like poison. Kesha’s composure never cracked. “My account number is visible on both the card and my identification,” she replied, voice unwavering.

But the system was rigged. Brad lied smoothly, pretending to find “multiple red flags” on his computer screen. Susan demanded employment verification, income documentation, and a detailed explanation of what Kesha planned to do with her own money. The humiliation was systematic, designed to break her spirit and force her to wait in a corner like a suspect.

As Maya’s live stream hit thousands of viewers, a security guard was summoned — his presence intended to intimidate, but his eyes betrayed discomfort. The scene escalated. Regional manager David Chen arrived, crisis mode activated. “Identity theft, document forgery, social engineering — criminals are getting very sophisticated,” he announced, performing for the crowd. Kesha was offered a choice: submit to hours of humiliating scrutiny or be denied access to her own funds.

The tension reached a boiling point. Kesha’s phone buzzed with texts from her assistant, board members, and her lawyer, all monitoring the live stream. Major news outlets began embedding Maya’s feed. The story was now unstoppable.

Then, the plot twisted. Kesha opened her leather portfolio and placed a business card on the counter. Brad glanced at it, dismissive, until David Chen’s face drained of color. “Thompson Financial Group owns 31% of First National Corporation,” Kesha announced, her voice cutting through the marble silence. “We’re the largest single shareholder. That’s my quarterly board review happening in the conference room.” The lobby fell into stunned silence. The woman they’d profiled, humiliated, and denied was not just a customer — she was the bank’s owner.

Maya’s live stream exploded. Viewer count jumped by the tens of thousands. Comments flooded in: “She owns the bank. Plot twist!” News organizations worldwide scrambled to cover the drama. The security guard, Jerome Washington, recognized Kesha from corporate newsletters. The humiliation had been inflicted on their boss’s boss’s boss.

Kesha revealed she’d been conducting anonymous visits to all First National branches, documenting customer service protocols. “You’ve provided exceptional data for our discrimination analysis,” she told Brad, who was visibly struggling to breathe. The evidence was irrefutable, captured on multiple devices, and now public for regulatory review.

Stock prices plummeted in after-hours trading. Corporate lawyers and federal regulators were notified within minutes. “Federal Equal Credit Opportunity Act violations carry penalties of up to $500,000 per incident,” Kesha reminded the stunned management. “The Community Reinvestment Act requires banks to serve all customers equally regardless of race.” Her legal background as a corporate attorney made her threats anything but empty.

The consequences were immediate. Brad’s twelve years of banking experience evaporated in the face of federal exposure. Susan Martinez and David Chen faced suspension and investigation for enabling systematic discrimination. Kesha outlined a comprehensive reform package: termination of all employees involved, mandatory bias training for all staff, real-time discrimination monitoring powered by AI, independent ombudsman authority, and a $25 million community investment fund supporting minority-owned businesses.

The accountability was unprecedented. Sterling, the bank president, had no choice but to accept every demand. “First National Corporation accepts full responsibility for yesterday’s discrimination incident. We’re implementing immediate and comprehensive reforms,” he announced to an emergency board meeting. Brad was terminated. Susan Martinez was dismissed for supervisory negligence. David Chen resigned, triggering investigations across other branches.

Jerome Washington, the security guard whose discomfort was recognized as integrity, was promoted to Director of Compliance and Customer Advocacy. Maya Patel, whose live stream exposed the scandal, was hired as external communications director. Dr. Angela Davis, a renowned civil rights attorney, was appointed as independent ombudsman with power to terminate employees for violations.

The ripple effects transformed the industry. Competing banks adopted similar reforms, recognizing Thompson Financial Group’s monitoring would expand to other portfolio companies. Federal regulators cited First National’s rapid response as a model for industry-wide reform. Investor confidence rebounded, stock prices reached new highs, and First National became a transformation success story.

Six months later, Kesha conducted a comprehensive assessment. The results were extraordinary: discrimination complaints dropped 52% across institutions implementing Thompson standards. Minority business lending increased 34% industry-wide. Maya Patel’s documentary “Owning Justice: A Banking Revolution” premiered at Cannes, winning the Palm d’Or for Best Documentary.

The Thompson Financial Group Equality Fund awarded $127 million in loans to minority entrepreneurs, creating over 8,400 jobs nationwide. Jerome Washington became a sought-after speaker at banking conferences, inspiring similar diversity initiatives. Brad Mitchell, after completing comprehensive bias training, now works for a credit union, sharing his experience as a cautionary tale.

The legacy of that day at First National Bank lives on every time a customer receives respectful service, regardless of race. The Thompson model spread to healthcare, retail, and hospitality sectors, with investment firms leveraging economic power to drive social progress. Real stories have real power, Kesha concluded at the Global Banking Equality Summit. “When we document injustice and demand accountability through strategic action, we create the change our communities deserve.”

If you’ve experienced discrimination in banking or financial services, share your story. Your voice matters. Your experience creates change. The quiet revolution sparked by one Black woman’s dignified resistance proved that economic justice can reshape entire industries — and that dignity is non-negotiable.