“Judge Laughs at Black Man’s DIY Defense—But Is Left Speechless by His Legal Genius and the Bank’s Dirty Collapse”

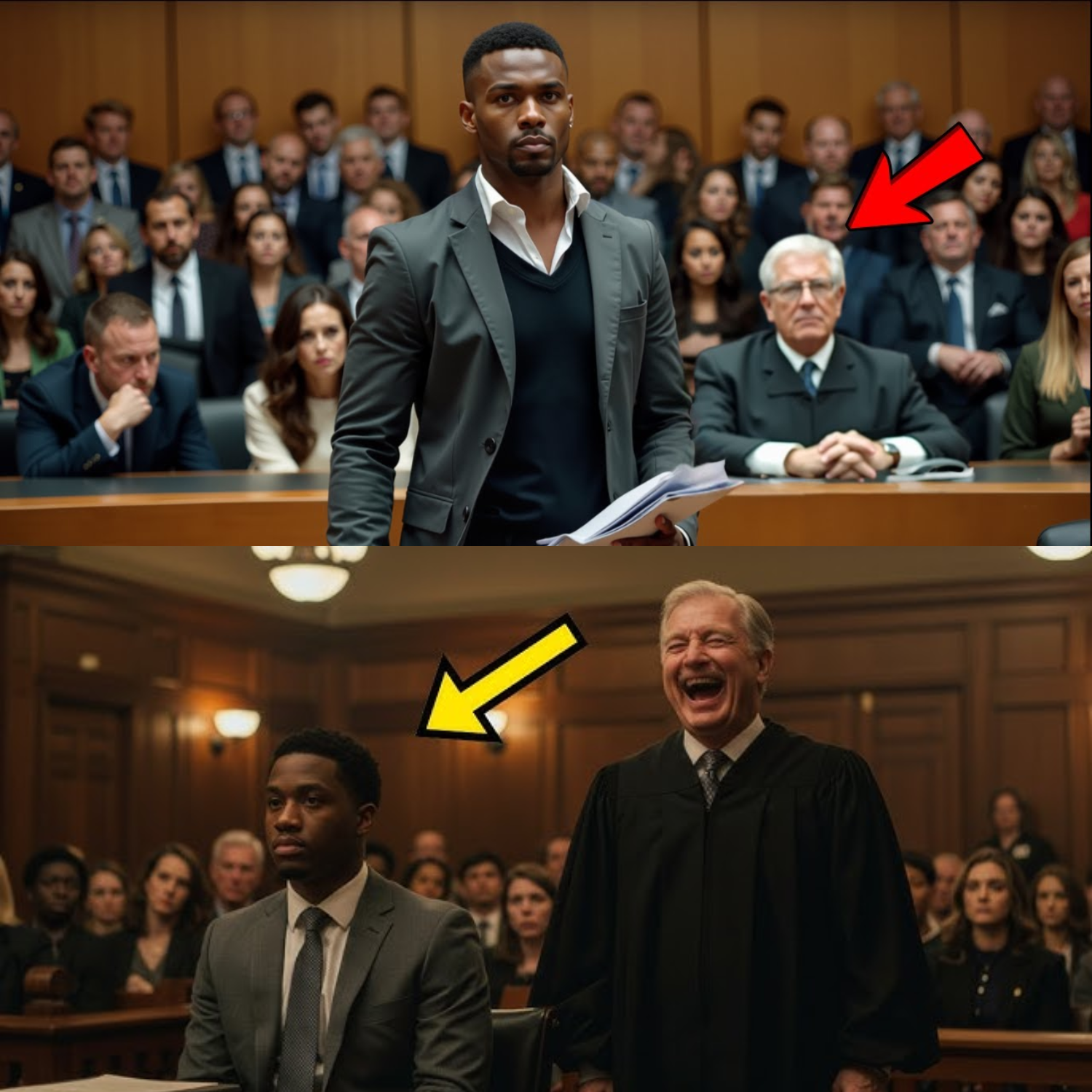

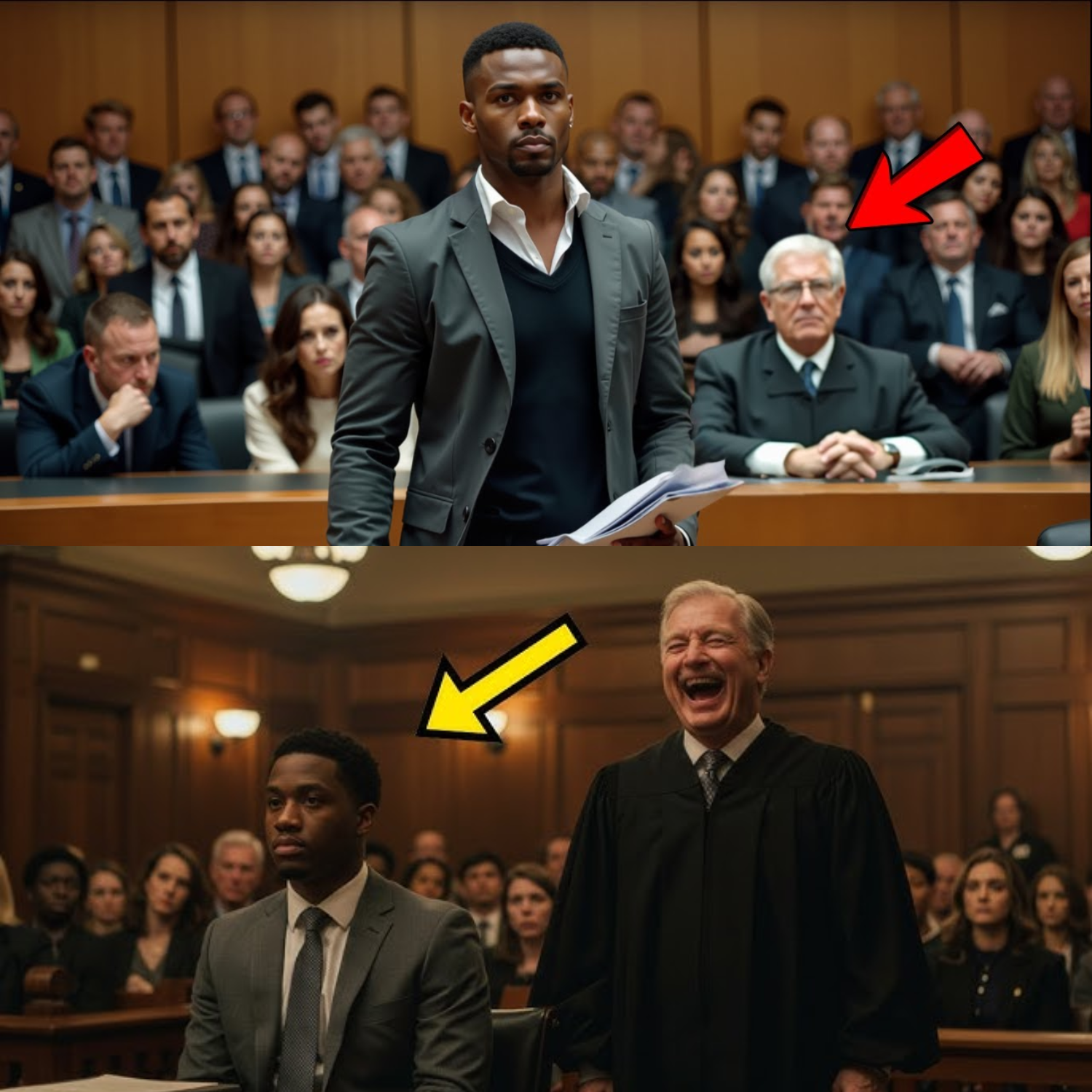

The courtroom buzzed with the low hum of skepticism as Malcolm Reese stood at the defendant’s table, alone. His suit was clean but worn, his posture straight but weary. Across from him, Bryce Lambert—the bank’s top attorney—lounged with the arrogance of a man who’d never lost a case. From the bench, Judge Ethan Crawley couldn’t hide a smirk. “Representing yourself, Mr. Reese?” he mocked, tapping his gavel lightly. “This should be entertaining.” The gallery snickered. But Malcolm’s eyes were steel. “I’m not here to entertain, Your Honor. I’m here to win.”

Six months earlier, Malcolm had clutched a blood-red eviction notice on his mother’s cracked front porch—the same porch she’d scrubbed clean after double shifts, the house she’d worked two jobs for, the heart of a legacy three generations deep. She’d died believing it was hers, free and clear. But now, the bank claimed a second mortgage, signed in a shaky hand that looked nothing like hers. The system was coming for everything she’d built.

Malcolm’s first call was to the bank. After half an hour on hold, a bored voice told him, “Sir, the account is in default due to non-payment on a second mortgage taken out two years ago. Foreclosure proceedings are final.” Malcolm’s protest was met with icy indifference. “Maybe you weren’t aware of her financial situation.” The insinuation stung. Malcolm demanded copies of every document. “File a request with legal,” the woman replied. “But it won’t stop the eviction.” The line went dead.

He drove straight to the bank, where branch manager Darren Klein—a middle-aged white man with a predatory smile—barely glanced at the paperwork before sneering, “People like you need to learn the system’s not made for you.” When Malcolm pointed out the forged signature, Klein shrugged. “Signatures change over time. People get desperate. Maybe she didn’t tell you.” Malcolm’s jaw clenched. “She didn’t take out this loan, and you know it.” Klein’s smile hardened. “Hire a lawyer. Act fast. You’ve got two weeks.”

Lawyers weren’t an option. Malcolm had lost his job in corporate downsizing. He worked part-time as a janitor at the local community center. Legal aid offices were at capacity; private firms wouldn’t touch a case they couldn’t win. Every paycheck went to bills and food. There was no room for legal fees. The system was designed to keep people like him powerless.

That night, Malcolm sat at the kitchen table, eyes burning from hours of reading. His girlfriend Nia texted, “How bad is it?” “Bad,” he replied, “but I’m not giving up.” The next morning, he visited legal aid—rejected. He tried town hall, hoping for help from Councilman Holloway, who patted his shoulder, “History doesn’t pay the bills, son.” The word hung in the air, heavy with condescension.

With days ticking down, Malcolm found a white notice taped to the door: Sheriff’s eviction scheduled. The fight was on. He spent sleepless nights cross-referencing documents, scrutinizing the shaky signature, and noticing the notary stamp looked faded, uneven—maybe copied. He searched online for mortgage fraud cases, finding horror stories of forged signatures and predatory loans. One case stood out: Martin v. Horizon Bank. The homeowner won by demanding all documents. Malcolm scribbled notes. If he could force discovery, maybe he’d have a shot.

He filed a motion for a stay of eviction. The courthouse clerk, skeptical, asked, “Are you representing yourself?” “Yes.” She sighed, “You’d be better off with an attorney.” But she stamped the forms. By noon, Malcolm was back home, exhausted. Nia called, “What if you lose? What if they throw everything out?” “I can’t think about that,” he muttered. “This isn’t just about a house. It’s about standing up to people who think they can steamroll us.”

Two days later, the court denied his motion. Malcolm stood in the courthouse, rejection letter trembling in his hand. He’d done everything right, but the system slammed the door. Fueled by frustration, he stormed into the bank, demanding the original loan documents. Klein smirked, “File a discovery request. Otherwise, this conversation is over.” Humiliated, Malcolm walked out, anger burning in his chest.

At the community center, Mrs. Holloway, an elderly Black volunteer, watched him mop floors. “Baby, you look like the world’s sitting on your shoulders.” Malcolm sighed. “It kind of feels that way.” She nodded, “When they push you to the edge, you got two choices—fall or fight. But if you’re going to fight, you’d best know their game better than they do.” Her words hit him like lightning.

Malcolm borrowed law books, printed foreclosure guidelines, and spent nights buried in paperwork. He found a single line in the statute: all mortgage transfers must have a valid endorsement from the previous lender. The bank’s filings lacked it. Legally, they couldn’t foreclose. He filed a new motion demanding discovery.

This time, the court granted it. The bank retaliated: froze his account, cut his utilities, repossessed his car. Klein’s voice on the phone was smug, “Funny how paperwork stirs up trouble.” Malcolm’s fists clenched. They wanted him to quit.

He attended another hearing. Bryce Lambert, the bank’s lead attorney, called his requests “a fishing expedition.” Judge Crawley, bored, said, “Signatures change over time.” Malcolm fired back, “Not in three months. Not when the second signature was supposedly signed the day after my mother was hospitalized for a stroke.” Crawley leaned forward, “You’re saying the bank falsified documents?” “Without full discovery, we’ll never know. If they have nothing to hide, they should provide the originals.” Crawley, annoyed, granted the request.

Three days later, the bank filed “new evidence”—a revised mortgage transfer with a polished, but still forged, signature. The sheriff’s deputies evicted him, dumping his family’s history on the curb. Neighbors watched, some with pity, others with satisfaction. Malcolm sat on the steps, defeated but not broken. “If they want a fight, I’ll give them one.”

He filed an emergency motion to contest the eviction, armed with proof of forgery. The clerk gave him a pitying look. “You really think you can win this?” “I know I can.” But the system wasn’t done punishing him. Deputies detained him for “trespassing” at his own house. He spent the night in a holding cell. The message was clear: back off or face consequences.

When released, he returned to the library, poring over statutes. He found another crack: the final transfer lacked a crucial endorsement. He filed another motion, challenging the bank’s standing. Lambert was waiting for him outside the courthouse, “You’re wasting your time.” Malcolm replied, “If you don’t have standing, you don’t have a case.” For the first time, Lambert’s smile flickered.

The bank retaliated harder. Malcolm lost his job at the community center—“Donors are nervous.” He was homeless, broke, and sleeping in his car. But then, a lifeline: Linda Ortiz, a former bank paralegal, handed him a folder of internal memos showing the bank targeted minority neighborhoods for fast-track foreclosures. “They figured people wouldn’t fight back,” she said. Malcolm’s anger burned hotter.

Two days later, Linda was fired, her account frozen. Denise Fowler, the notary, admitted she hadn’t witnessed the signature. “A banker brought me the papers, said the client was sick. I stamped it without thinking.” Malcolm promised her, “If we don’t fight this, they’ll keep doing it.” Denise agreed to testify.

Armed with evidence and allies, Malcolm returned to court. Lambert objected, “Baseless claims.” Malcolm presented the notary’s affidavit and Linda’s emails. “The bank rushed the eviction, bypassing procedures. They harassed witnesses, froze accounts, and fabricated documents.” Crawley, finally paying attention, granted a temporary stay.

The bank filed an emergency motion to dismiss. Malcolm and Boyd, from The Justice Collective, countered with Denise’s affidavit, Linda’s memos, and evidence of a pattern of fraud. The court scheduled an expedited hearing. The bank sent private investigators to intimidate Malcolm. He stood his ground.

At the final hearing, the courtroom was packed. Lambert called the discrepancies “clerical errors.” Boyd argued, “If that’s true, why hasn’t the bank produced the originals?” Denise testified, “I was misled by a bank representative.” Lambert’s calm cracked. Malcolm presented cases of similar fraud in minority neighborhoods. “This isn’t just about my house. It’s a pattern of systemic abuse.”

Judge Crawley, cornered, ordered the bank to produce all original documents within seven days. The bank filed another emergency motion to dismiss. Malcolm had ten days to prove malicious intent. Linda found a grainy security video: Klein, the manager, telling executives, “If we delay processing just enough, by the time they realize the signatures don’t match, it won’t matter. The court will side with us.” It was the smoking gun.

At the final showdown, Malcolm played the video. The courtroom erupted. Crawley, finally defeated, declared, “This court finds sufficient evidence of malicious foreclosure fraud. The foreclosure is nullified. An investigation into First Union Bank is ordered. Mr. Lambert is referred for ethical violations.”

Outside, reporters swarmed. Boyd clapped Malcolm on the back, “You did it. You blew the whole thing open.” Nia squeezed his hand. Linda and Denise stood nearby, battered but victorious. The bank offered a six-figure settlement—Malcolm refused. “I’m not for sale.”

The fallout was swift: Klein resigned, Lambert was suspended, Crawley investigated. Families across the city kept their homes. Malcolm’s fight had exposed a network of corruption, proving that resilience, knowledge, and community can topple even the most toxic system.

Power doesn’t belong to those with money, titles, or connections—it belongs to those who refuse to back down. Malcolm Reese was just getting started.

What do you think? Should Malcolm have taken the settlement, or was he right to fight to the bitter end? Comment below, like, and share if you believe justice is worth every risk. Because the fight for justice doesn’t end in the courtroom—it continues every day, in every community. Stay vigilant, stay informed, and never underestimate the power of one determined voice.